*99# – Just Dail & Get Any Information Your Bank Account Details.(Full Guidelines):-

Hello Guys Today I Am Sharing This Awesome Trick To Just Dail *99# – You are just Dail This Number & Get Your All Bank Details Or Facilitys In Your Mobile . Just Like Your Mini Statement Or Mini Transfer , Your All Account Details.USSD Based Mobile Banking, Check Bank Account Balance Offline, *99# USSD Mobile Based Banking, Mini statement and more without internet connectivity. India is gradually moving towards becoming a cashless economy, and the recent demonetization of old currency is serving as a catalyst in achieving PM Narendra Modi’s dream of Digital India.

Hindi (*99*22#)

Marathi (*99*28#)

Bengali (*99*29#)

Punjabi (*99*30#)

Kannada (*99*26#)

Gujarati (*99*27#)

Tamil (*99*23#)

Telugu (*99*24#)

Malayalam (*99*25#)

Oriya (*99*32#)

Assamese (*99*31#).

USSD banking daily transaction limit and charges:-

According to the Reserve Bank of India (RBI), the USSD Based Mobile Banking pa yment method can be used for sending money as low as Re 1, and as much as Rs 5,000 per transaction. Coming to charges, you will be charged Rs 0.50 per transaction, which will be added in your mobile bill. The service works 24 hours a day and 7 days a week. However, carriers have waived off the transaction charges till December 31.

Getting started with USSD Based Mobile Banking:-

First and foremost, you need a phone, a bank account and your mobile number registered for mobile banking. In case your phone number isn’t registered with your bank, you’ll have to visit the branch and fill-up a form to register and link it with your bank account. Once that is done, you’ll have to generate Mobile Money Identifier (MMID) number. It is a random seven-digit number issued by the bank. The MMID is usually sent to you by the bank after you register for mobile banking.

How to use USSD Based Mobile Banking codes:-

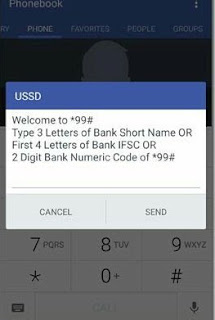

GPU will see the welcome screen after which you will have to enter first three letters, or IFSC code or 2-digit bank code followed by send.

How to transfer money using USSD Based Mobile Banking Codes:-

In this example, I’ve used HDFC bank account to send money to my colleague using his MMID number. So, let’s see how to go about it.

Step 1: Dial *99#, type bank name, and when the interface opens, enter 3’ and tap send.

Step 2: Enter beneficiary mobile number

Step 3: Enter beneficiary MMID, which you will have to get from the person you are sending money to.

Step 4: Next, you need to enter amount and remarks (separated by space). For instance, I transferred Rs 5 to test how this works, so it looks like “5 Test”

Step 5: In the final step, you have to enter your MPIN to authorize the transaction and last 4 digits of your account number (separated by space), and tap on send. That’s it, once your transaction is authorized, the money will be instantly credited to the recipients account.

USSD Based Mobile Banking limitations:-

While the service does enable non-smartphone and non-internet users to send money using their phones, it is quite a tedious process. To begin with, once the USSD popup notification arrives, you have to respond within 10 seconds, or the process will get cancelled. When I was testing, I struggled to reach to step five as it would often throw an error saying External application down.’ It gets quite annoying as you have to start over again, and again at such times. Having said that, the service still seems in its nascent stages and improvements could be expected going forward

THANKYOU FOR VISITING OUR BLOG,PLEASE STAY TUNED TO KZCTRICKS

No comments:

Post a Comment